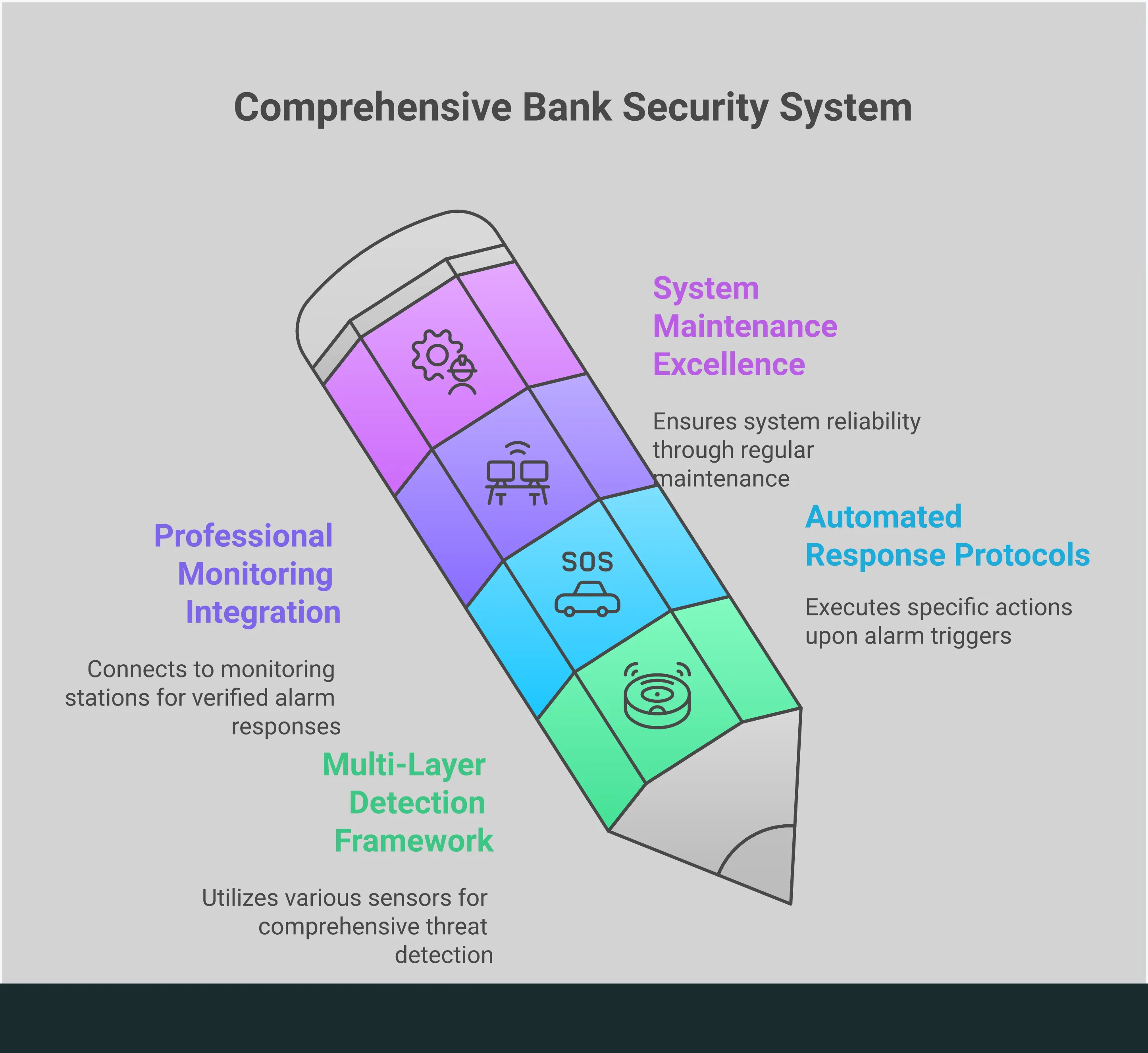

A security camera, a door lock, and an alarm bell are just individual tools. On their own, they offer limited protection. The real power comes from making them work together as a single, intelligent unit. A modern bank alarm system acts as the brain of this integrated ecosystem, ensuring every component communicates and collaborates. When an unauthorized access attempt occurs, the system doesn’t just sound an alarm—it can automatically lock down the area, trigger specific cameras to record, and send an immediate, verified alert to a monitoring center. This seamless synergy transforms your security from a passive setup into an active defense.

Key Takeaways

- Integrate for a Smarter Defense: A standalone alarm is just a noisemaker. True security comes from connecting your alarm with video surveillance and access control to create a unified system that verifies threats, automates responses, and provides a complete picture of any event.

- Prioritize Professional Support from Day One: The effectiveness of your system depends on proper installation, thorough staff training, and consistent maintenance. Partnering with an expert ensures your system is set up correctly and remains reliable for years to come.

- Active Management is Key to Reliability: Get the most from your investment by implementing protocols to reduce false alarms, leveraging remote access for real-time oversight, and ensuring a rapid response with 24/7 professional monitoring.

What is a Bank Alarm System?

When you think of a bank alarm, you might picture a classic silent alarm triggered during a robbery. But in reality, a modern bank alarm system is much more than that. It’s a sophisticated, integrated network of physical and electronic security measures working together. The goal is to do more than just react to a crisis; it’s about proactively deterring crime, instantly detecting breaches, and protecting your assets, customers, and employees around the clock. This comprehensive approach is the foundation of modern financial security, creating layers of protection that address threats before they escalate.

Think of it as a complete security ecosystem tailored specifically for the high-stakes environment of a financial institution. It combines different technologies to create a unified defense, from the parking lot to the vault. A truly effective system doesn’t just sound an alarm—it provides real-time intelligence, controls access to sensitive areas, and creates a verifiable record of all activity. By connecting every piece of your security puzzle, from cameras to door locks, you get a system that is smarter, faster, and more reliable than any single component could be on its own. This synergy is what separates a basic alarm from a true security solution.

What Are the Core Components?

A bank alarm system is built from several key components, each playing a distinct role. At the heart of the system are sensors that detect unauthorized activity, such as motion detectors in lobbies and vibration sensors on vault walls. High-definition video surveillance systems act as your digital eyes, capturing clear footage of everything that happens on your premises.

Panic buttons, both fixed and wireless, provide a discreet way for staff to signal for help during an emergency. Beyond intrusion, the system also includes environmental detectors for threats like fire or gas leaks. Finally, a central control panel ties everything together, processing signals from all components and communicating with a 24/7 monitoring center.

How the System is Structured

The structure of a bank alarm system is based on layers and zones. It’s designed to manage who can go where and when, creating a secure environment from the outside in. The outermost layer might involve perimeter surveillance, while the next layer focuses on controlling entry into the building itself. This is managed by an access control system that uses key cards, fobs, or even biometric scanners for employees.

Inside, the building is divided into zones with varying levels of security. Public areas like the lobby have different protocols than restricted areas like teller stations, server rooms, and the vault. This zoned approach ensures that even if one area is compromised, your most critical assets remain protected behind additional layers of security.

How It Integrates with Other Security Measures

The real power of a modern bank alarm system lies in its ability to integrate. Instead of having a dozen standalone devices, an integrated system ensures all components communicate and work together. For example, if an access control reader denies entry to someone at a sensitive door after hours, the system can automatically trigger the nearest camera to zoom in and record, while simultaneously sending an alert to security personnel.

This seamless connection between intrusion detection, access control, and video surveillance creates a smart, responsive security network. It reduces manual oversight, speeds up response times, and provides a more complete picture of any security event. This level of integration transforms your security from a passive collection of hardware into an active, intelligent defense system.

Today’s Must-Have Security Features

To meet today’s security challenges, a bank alarm system needs to be equipped with advanced features. High-resolution cameras that capture crystal-clear video are no longer a luxury—they’re a necessity for accurate identification. The system should also be supported by 24/7 professional monitoring to ensure that every alert is assessed and acted upon immediately by trained experts.

Artificial intelligence (AI) analytics are also becoming standard, enabling your system to distinguish between a real threat and a false alarm. Advanced sensors can even detect unusual sounds or air quality changes. Finally, the system must have immediate and multi-channel response capabilities, like an emergency notification system that can instantly alert staff and law enforcement the moment a threat is verified.

The Building Blocks of Bank Security

A modern bank alarm system is much more than a simple siren. It’s a sophisticated, multi-layered network of technologies working together to protect your assets, employees, and customers. Think of it as a digital fortress where each component plays a critical role in maintaining security. Relying on a single security measure, like just an alarm or just cameras, leaves significant gaps that can be exploited. The real strength comes from how these individual systems integrate and communicate with one another. When motion is detected after hours, cameras are triggered. When a restricted door is forced open, an immediate alert is sent. This interconnected approach creates a comprehensive shield that covers all your bases. From deterring potential threats before they happen to providing crucial evidence after an incident, these building blocks form the foundation of a secure financial institution. Understanding how each piece functions helps you create a strategy that leaves no room for vulnerabilities.

Video Surveillance Systems

Clear, reliable video footage is non-negotiable in banking. Modern security camera systems use high-resolution cameras to provide a sharp, detailed view of everything happening on your property. Strategic placement is key—cameras should monitor all critical zones, including lobbies, teller areas, ATMs, drive-up windows, and parking lots. This constant monitoring acts as a powerful deterrent for criminals and, if an incident does occur, provides indisputable evidence for investigations. Integrating these cameras with your alarm system ensures that any triggered event can be visually verified in real time, allowing for a faster and more accurate response from law enforcement.

Access Control Solutions

You need to have complete authority over who can enter specific areas of your facility. This is where access control solutions come in, replacing traditional locks and keys with more secure methods like key fobs, key cards, and unique access codes. These systems allow you to grant or restrict entry based on an individual’s role and the time of day. For highly sensitive areas like vaults or server rooms, you can implement “Dual Authority” protocols, which require two authorized individuals to be present to grant access. This granular control not only prevents unauthorized entry but also creates a detailed digital log of every person who enters a secured area.

Motion Detection Technology

Your bank’s security needs don’t stop when the last employee leaves for the day. Motion detection technology is your after-hours guardian, using advanced sensors that deploy infrared, microwave, or ultrasonic waves to detect movement within a protected zone. If one of these detection sensors is triggered when the system is armed, it immediately sends an alert to your monitoring station and the appropriate authorities. These sensors are a fundamental part of a layered security approach, ensuring that any unauthorized presence is identified instantly. When integrated with your surveillance system, a motion trigger can also prompt specific cameras to begin recording, capturing the event as it unfolds.

Emergency Response Systems

In a high-stakes situation like a robbery, the safety of your employees and customers is the top priority. Emergency response systems provide a discreet and immediate way for staff to signal for help. Devices like silent panic buttons can be installed at teller stations or in back offices, allowing an employee to alert law enforcement without escalating a dangerous situation. These systems are a core component of a comprehensive emergency notification plan, ensuring that help is dispatched quickly and quietly. This immediate line of communication is crucial for minimizing risk, protecting everyone on-site, and managing emergencies effectively.

Biometric Authentication

As security threats evolve, so does the technology used to stop them. Biometric authentication adds an incredibly strong layer of security by verifying a person’s identity based on unique biological traits. Technologies like fingerprint scanning, facial recognition, and even voice identification are becoming more common in banking security. Because these traits are nearly impossible to duplicate or steal, biometrics provide a much higher level of assurance than a key card or password. This technology is often integrated into access control systems to protect the most sensitive areas, ensuring that only specific, verified individuals can gain entry.

How to Choose the Right Alarm System

Selecting the right alarm system for your financial institution is a big decision. It’s not just about picking hardware; it’s about designing a security ecosystem that protects your assets, employees, and customers. A great system is reliable, scalable, and tailored to your specific needs. To make the best choice, you’ll want to look at everything from individual features and overall cost to how the system integrates with your current setup and what kind of support you can expect down the line. Let’s walk through the key factors to consider.

What Features Should You Look For?

Modern bank security goes far beyond a simple door alarm. You need a system that creates multiple layers of protection. Look for solutions that combine motion sensors, glass-break detectors, and even seismic sensors to detect a wide range of threats. A truly effective alarm system doesn’t work in isolation. It should seamlessly connect with your other security measures, like access control systems and video surveillance. When these components communicate, they create a comprehensive security solution that can automatically lock doors, trigger cameras, and alert authorities the moment an intrusion is detected, giving you a smarter and faster response.

Assessing Cost vs. Value

While budget is always a factor, it’s helpful to think about your alarm system as a long-term investment in security, not just a one-time expense. The initial cost for equipment and installation is only part of the picture. You also need to consider the value it provides in protecting high-value assets and ensuring peace of mind. The most effective approach is to balance cost with effectiveness, prioritizing investments that address your most significant risks. A cheaper system that fails during a critical moment is far more costly than a robust, reliable one that performs exactly as needed.

Ensuring System Compatibility

Before committing to a new alarm system, make sure it can integrate smoothly with your existing infrastructure. Consider whether a wired or wireless system is a better fit for your building’s layout and construction. The ideal system should be scalable, allowing you to easily add new components or adjust coverage as your institution’s needs change over time. This flexibility is key to future-proofing your security. For example, ensuring your system can work with modern fiber network technology can improve speed and reliability, making your entire security operation more resilient and efficient.

Understanding Installation Needs

Proper installation is just as important as the quality of the equipment itself. For a financial institution, this is a job for professionals. A proven installation process involves several key steps, starting with a thorough site assessment and a strategic design plan for device placement. From there, technicians handle the physical installation, system configuration, and rigorous testing to confirm every component is working correctly. This methodical approach ensures there are no gaps in your coverage and that the system is optimized for your unique environment, providing reliable protection from day one.

Evaluating Ongoing Support Options

Your relationship with your security provider shouldn’t end after the installation. Look for a partner who offers comprehensive ongoing support to keep your system in peak condition. This includes regular maintenance checks to clean sensors, test connections, and manage software updates. More importantly, you need access to 24/7 professional monitoring and responsive technical support. When an alarm is triggered, you want experts ready to act immediately. Consistent service and support are critical for protecting your investment and ensuring your security system remains a reliable shield for your institution.

How to Meet Banking Security Standards

Meeting security standards in the banking industry is about more than just checking off boxes on a compliance form. It’s about building a fortress of trust around your institution, your employees, and your customers’ assets. The financial sector is governed by a complex web of federal and industry-specific regulations designed to protect against a wide range of threats, from armed robberies to sophisticated data breaches. Adhering to these standards is non-negotiable, as failure can result in significant fines, legal trouble, and irreversible damage to your reputation.

Think of compliance as a continuous process, not a one-time project. It requires a deep understanding of the rules, the implementation of robust security protocols, and diligent record-keeping. A truly effective security strategy doesn’t just meet the minimum requirements; it exceeds them. This is achieved by integrating various technologies—like high-definition video surveillance, advanced access control, and intelligent alarm systems—into a single, cohesive ecosystem. This proactive approach provides a powerful defense against current threats while being flexible enough to adapt to future challenges, ensuring your institution remains a safe and trusted place to do business.

Key Banking Industry Regulations

To build a compliant security framework, you first need to understand the rules of the road. Several key regulations set the standard for security in financial institutions. The Bank Protection Act of 1968 is a foundational piece of legislation that mandates specific physical security measures to deter robberies and other crimes. For credit unions, the Code of Federal Regulations Part 748 outlines similar security program requirements. Additionally, any institution that processes, stores, or transmits credit card information must adhere to PCI Compliance standards, which ensure that access to cardholder data is strictly controlled and monitored to prevent fraud.

Staying on Top of Compliance

Compliance isn’t a “set it and forget it” task. Regulations evolve, technology changes, and new threats emerge. Staying on top of compliance means treating it as an ongoing commitment. This involves regular system checks, software updates, and staff training to ensure your protocols remain effective. Partnering with a security expert can be invaluable here. A good partner will not only help you install a compliant system but will also provide continuous service and 24/7 monitoring. They stay informed about regulatory changes and can help you adapt your security posture accordingly, ensuring you’re always prepared for an audit and, more importantly, for a real-world threat.

Establishing Strong Security Protocols

With the regulations in mind, the next step is to establish strong internal security protocols. This starts with implementing specialized alarm systems designed specifically to address the unique risks faced by banks, such as break-ins, robberies, and unauthorized access to sensitive areas. However, these alarms shouldn’t operate in a vacuum. For maximum effectiveness, they must be integrated with your other security measures. For example, an alarm triggered at a teller station can automatically activate specific cameras, lock down certain doors through your access control system, and send an immediate alert to a monitoring center and law enforcement, creating a rapid and coordinated response.

What Documentation Do You Need?

Proper documentation is the backbone of any compliance strategy. It’s the proof that you are taking security seriously and performing the necessary due diligence. You should maintain detailed records of all security-related activities. This includes regular system maintenance, such as camera lens cleanings, weatherproofing checks for outdoor equipment, and tests of your alarm sensors. It also means keeping logs of who accesses secure areas and when, as well as documenting all software updates and system changes. This meticulous record-keeping is not just essential for passing audits; it’s crucial for troubleshooting issues, optimizing system performance, and protecting your security investment over the long term.

From Installation to Training: What to Expect

Choosing and installing a new bank alarm system is a significant step, but the process is much more than just mounting hardware on the walls. A true security partner guides you through every stage, from the initial conversation to the moment your team is fully prepared to use the new system. Understanding this journey helps you plan for a smooth transition and ensures you get a security solution that’s perfectly tailored to your institution’s needs. It’s a collaborative effort designed to build a secure environment from the ground up, making sure every component works together flawlessly.

This comprehensive approach covers everything from the initial assessment and physical installation to in-depth training and seamless system integration. It turns a complex project into a manageable and successful upgrade for your facility, giving you peace of mind that your investment is sound and your security is solid. We’ll walk through what you can expect at each step, so you feel informed and in control throughout the entire process. From the first site walk-through to the final system handover, each phase is designed to build upon the last, resulting in a robust security posture that protects your assets, staff, and customers.

The Initial Security Assessment

Before a single wire is run, the process begins with a comprehensive security assessment. This isn’t a generic checklist; it’s a deep look into your bank’s specific operational flow, physical layout, and potential vulnerabilities. A security expert will evaluate everything from the perimeter of your property to the vault itself, considering factors like high-traffic areas, after-hours access points, and the security of your ATM vestibules. This foundational step ensures your alarm system is designed to address your unique risks. The goal is to create a detailed blueprint for a system where every sensor and camera has a clear purpose, giving you effective coverage exactly where you need it.

Steps for a Professional Installation

Once the design is finalized, the professional installation begins. This is a structured, multi-step process handled by certified technicians to minimize disruption to your daily operations. The first phase involves the strategic placement and mounting of all devices, including motion detectors, door contacts, and panic buttons. Next, technicians carefully run all necessary wiring and connect every component to the central control panel. The final, and most critical, stages are configuration and testing. The system is programmed to your specifications, and every single function is tested repeatedly to guarantee it performs reliably and communicates instantly when an alert is triggered.

Why Staff Training is Crucial

The most advanced security technology is only effective when your team knows how to use it with confidence. Proper staff training is a non-negotiable part of any security system implementation. This goes far beyond simply learning to arm and disarm the system. Your team will learn how to interpret different types of alerts, understand the specific protocols for various emergency scenarios, and manage user access. Thorough training empowers your staff to act as your first line of defense, ensuring they can respond quickly and correctly in a real emergency. It also plays a huge role in preventing the false alarms that can lead to unnecessary costs and complacency.

Integrating Your New System Seamlessly

A modern bank alarm system shouldn’t stand alone. Its true strength is revealed when it’s integrated with your other security measures. A comprehensive solution connects your alarm with your access control systems and video surveillance network. This integration creates a powerful, unified security platform. For example, when an alarm is triggered in a restricted area, the system can automatically lock nearby doors and pull up live video feeds from the closest cameras. This allows your team to manage the entire security environment from a single, intuitive interface, leading to faster, more informed responses and a much stronger overall security posture.

Keeping Your System in Peak Condition

Installing a state-of-the-art alarm system is a fantastic first step, but the work doesn’t stop there. Think of your security system like a high-performance vehicle; it needs regular attention to operate at its best. Consistent maintenance and testing are what transform a good security setup into a reliable one that protects your assets, employees, and customers day in and day out. A well-maintained system not only ensures compliance but also maximizes the return on your investment by extending its lifespan and preventing costly emergency repairs.

This ongoing care is crucial for identifying potential vulnerabilities before they can be exploited. From software updates to physical hardware checks, a proactive approach guarantees that every component functions exactly as it should when you need it most. Let’s walk through the essential practices for keeping your bank’s alarm system in top form.

How to Conduct Regular System Tests

Your alarm system needs to be more than just present; it needs to be proven. The only way to be certain it will work during an emergency is to test it regularly. Industry best practices recommend that alarm systems be inspected, tested, and maintained by qualified personnel to ensure every sensor, keypad, and siren is fully operational. This isn’t a task to delegate to an untrained staff member.

Work with your security provider to establish a consistent testing schedule—whether it’s monthly, quarterly, or semi-annually. These tests should be comprehensive, covering everything from motion detectors and door contacts to the communication link with the monitoring center. Documenting each test creates a clear record of your system’s health and demonstrates due diligence, which is essential for both compliance and peace of mind.

Managing Software and System Updates

Modern security systems are deeply integrated with software, which means they require regular updates just like your computer or smartphone. These updates are critical for patching security vulnerabilities that could otherwise be exploited. They also often include performance improvements and new features that make your system more effective. Neglecting software updates leaves your entire network exposed to potential threats.

Beyond the software, physical components also need attention. Regular maintenance should include tasks like cleaning security camera lenses for a clear picture and checking the weatherproofing on outdoor devices. Managing your digital video storage is also key to ensuring you have a reliable record of events. A comprehensive plan for your security camera systems protects your investment and ensures your system is always ready to perform.

Finding the Right Technical Support

When a part of your security system malfunctions, you need a fast and effective solution. The fear that a single issue will require a complete and costly overhaul is a common one, but it’s often unfounded. The right technical support partner can diagnose problems accurately and provide targeted repairs without unnecessary downtime or expense. You need a team that understands the intricacies of your system and can get it back online quickly.

Look for a provider that offers responsive, expert support as part of their service agreement. Having a dedicated team on call means you aren’t left scrambling when an issue arises. This relationship is your first line of defense against system failures, ensuring that any problems are addressed by professionals who know your setup inside and out.

The Role of Professional Monitoring

An alarm that sounds in an empty building is just noise. For a bank alarm system to be truly effective, it needs professional monitoring. A dedicated monitoring service provides 24/7 oversight, ensuring that every alert is seen and acted upon immediately. When an alarm is triggered—whether it’s a panic button, a breach sensor, or a fire alarm—a signal is sent to a central station where trained operators are ready to respond.

These operators quickly verify the alarm to rule out false positives and, if the threat is real, dispatch the appropriate emergency services to your location. This immediate, professional response is something self-monitoring simply can’t replicate. It’s an essential layer of security that ensures a swift reaction to any threat. Integrating this with emergency notification systems creates an even more robust response plan.

Why Preventive Maintenance Matters

Waiting for something to break is a reactive strategy that leaves your institution vulnerable. Preventive maintenance is about staying ahead of problems. Just as criminals find new ways to attack, your physical security systems need to be updated and maintained to counter emerging threats. Regular service visits can identify and fix small issues, like a frayed wire or a failing backup battery, before they cause a major system failure.

This proactive approach not only prevents security gaps but also saves you money in the long run by avoiding expensive emergency repairs and system downtime. A scheduled maintenance plan is an investment in reliability. It ensures your security system remains a strong, dependable defense for your financial institution, adapting to new challenges and providing uninterrupted protection.

How to Get the Most Out of Your System

Installing a state-of-the-art alarm system is a fantastic first step, but it’s not the last. To truly secure your financial institution, you need to actively manage and optimize your system. Think of it like a high-performance car—it has incredible potential, but it needs a skilled driver and regular tune-ups to perform at its best. Getting the most out of your security investment means understanding how to minimize disruptions like false alarms, ensure the fastest possible response when a real threat occurs, and leverage modern features like remote access and AI.

A well-managed system is more than just a deterrent; it becomes an active part of your daily operations. By integrating different security layers, you create a resilient network where each component supports the others. For example, your access control system can work in tandem with your video surveillance to verify identities and flag unauthorized entry attempts instantly. This integrated approach, combined with smart strategies for maintenance and staff training, transforms your security setup from a passive collection of hardware into a dynamic, intelligent defense shield that protects your assets, employees, and customers around the clock.

Tips to Prevent False Alarms

One of the biggest headaches with any alarm system is the risk of false alarms. They can be disruptive, costly if they result in fines, and can lead to complacency. The good news is that most false alarms are preventable. It starts with a professional installation to ensure every sensor is placed correctly and calibrated for your specific environment. From there, consistent staff training is key. Human error is a leading cause of false alarms, so make sure your team knows exactly how to arm and disarm the system, what to do if they accidentally trigger it, and who to call for support. Finally, don’t forget regular maintenance. Routine check-ups can catch minor issues before they turn into major problems that cause the system to malfunction.

How to Optimize Emergency Response Times

When a real emergency happens, every second counts. The best way to ensure a rapid response is to have your alarm system professionally monitored and integrated directly with local emergency services. When your system is connected to a 24/7 monitoring center, a trained professional can verify the alarm and dispatch police or fire departments immediately. This direct line of communication cuts out delays and ensures that first responders receive accurate information before they even arrive on the scene. An integrated emergency notification system can also automatically alert key personnel within your organization, allowing your team to execute its security protocols without hesitation.

The Benefits of Remote Management

In today’s connected world, you shouldn’t have to be on-site to know your facility is secure. Remote management capabilities give you the power to monitor and control your security system from anywhere using a smartphone, tablet, or computer. You can check the status of your alarms, view live video feeds from your security cameras, and even grant or revoke access to specific areas remotely. This level of control is incredibly empowering. It allows you to respond to alerts in real-time, make immediate adjustments as needed, and maintain complete situational awareness, whether you’re in a meeting across town or at home after hours.

Building Redundancy for Uninterrupted Security

What happens if a single component of your security system fails? Without redundancy, you could be left with a critical vulnerability. Building redundancy means creating a layered, integrated security network where there is no single point of failure. By connecting your alarm system with video surveillance, access control, and other security measures on a single platform, you create a more resilient defense. If a camera goes offline or a sensor is tampered with, other parts of the system can compensate and immediately alert you to the issue. This ensures that your security remains active at all times, giving you uninterrupted protection against any potential threats.

Using AI to Enhance Your Monitoring

Artificial intelligence (AI) is transforming security monitoring from a reactive to a proactive process. Modern alarm systems use AI-powered analytics to be much smarter about identifying real threats. Instead of just detecting motion, an AI-enhanced system can distinguish between a person, a vehicle, and a stray animal, which dramatically reduces false alarms. These systems can also learn the normal patterns of activity at your facility and flag unusual behavior that might indicate a potential threat. By leveraging advanced tools like an air and sound detection sensor, you get more accurate alerts, allowing your team to focus on what truly matters.

Related Articles

- Financial Institution Alarm Systems: Key Features & Considerations – Umbrella Security Systems

- Commercial facility security systems – Umbrella Security Systems

- Access Control Systems for Business | Free Security Assessment

Frequently Asked Questions

What’s the real difference between a standard alarm and a fully integrated security system? A standard alarm is designed to do one thing: make noise when a sensor is tripped. An integrated system is much smarter. It connects your alarm with your access control and video surveillance, creating a coordinated response. For example, when a restricted door is forced open, the system can automatically lock other doors in the area, trigger the nearest cameras to record, and send an immediate, detailed alert to a monitoring center. It’s about creating an intelligent reaction, not just a loud one.

Can a new alarm system work with the security cameras we already have? In many cases, yes. A key part of designing a new system is assessing your current infrastructure. Modern security platforms are often built to be compatible with a wide range of existing hardware. A professional security partner can evaluate your current cameras and other equipment to see how they can be integrated into a new, unified system. This approach helps you make the most of your previous investments while still upgrading your overall security.

How does a modern alarm system help us stay compliant with banking regulations? Banking regulations like the Bank Protection Act require specific security measures and diligent record-keeping. A modern, integrated system helps you meet these requirements by design. It provides detailed digital logs of who accesses secure areas and when, creates a verifiable record of all security events, and ensures your physical deterrents are active and monitored. This makes audit preparation much simpler and demonstrates a proactive approach to security.

What is the first step if we’re considering upgrading our bank’s security system? The process always starts with a conversation and a thorough security assessment of your facility. A security expert will visit your site to understand your specific layout, daily operations, and potential vulnerabilities. This isn’t a sales pitch; it’s a collaborative step to map out a solution that truly fits your needs and addresses your unique risks before any decisions about hardware are made.

Why is 24/7 professional monitoring so important if we have staff on-site? Even with staff present, their primary focus is on serving customers and managing daily operations, not watching security feeds. Professional monitoring provides a dedicated team of trained experts whose only job is to watch for alerts around the clock. When an alarm is triggered, they can verify the threat and dispatch emergency services immediately, ensuring a rapid and appropriate response every time, whether it’s during a busy afternoon or in the middle of the night.